Questions & Answers

More about Wealthstack and financial planning in general.

What is a financial planning dashboard?

Why do I need a “Critical Illness Insurance goal?”

Why do I need a “Disability Income Protection goal?”

Why do I need a “Life Insurance goal?”

How much do I need in my emergency fund goal?

How much do I need to save per child for tertiary education?

Can I implement any life, disability and critical illness insurance through Wealthstack?

Which of the insurance companies will you make use of to implement my insurance?

How will you implement my investment products?

Is Wealthstack a robo-advisor?

What fees do I pay when you implement insurance products for me?

What fees do I pay when you implement an investment product for me?

Can I consolidate my other insurance contracts and investment products onto my Wealthstack Dashboard even though Wealthstack is not managing it?

Can I speak to any of your experts / financial advisors and how much does it cost?

How can Wealthstack help me if I want to connect with a qualified expert / financial advisor to guide me through my financial planning dashboard and implementation?

If I am a business owner with complex company structures and trusts, can Wealthstack still help me?

Finances and financial planning is very personal.

Trust is built over time.

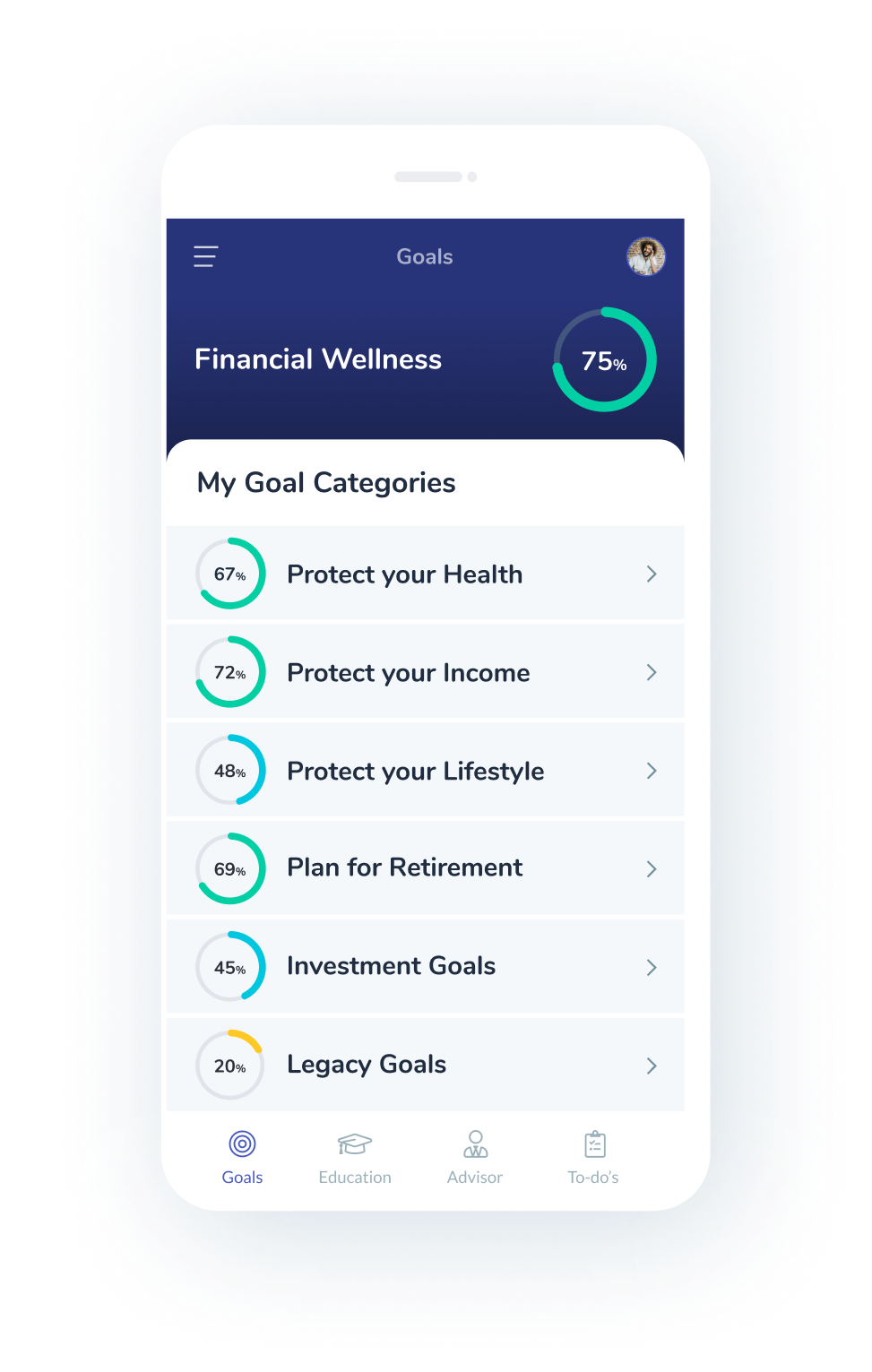

Coming Soon!

- View and manage your profile from your phone.

- Share your goals with your family members.

- Manage TODOs between you, your advisor and your partner.

- Get regular goal recommendations and financial insights.