How Financial Planning has changed and why you should care

You need 5 times as much money to retire today as your grandparents did.

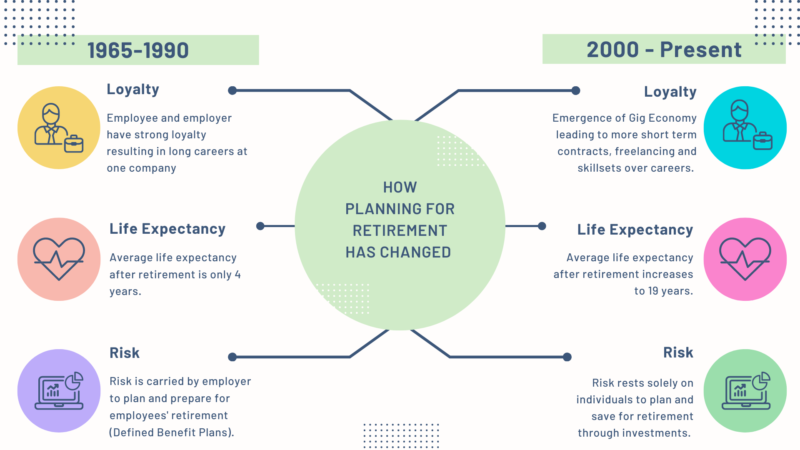

This statement is a sobering reminder that financial planning has radically changed in the last 60 years. Preparing for retirement, and even retirement itself, look nothing like it did in the 60s or the 80s. Perhaps it’s time to rethink retirement and plan differently.

How Financial Planning has changed in the last 60 years

The Loyal Era

In the 1960s, with World War II in the rearview mirror, the 3rd Industrial Revolution began. This saw a major shift worldwide in many aspects of life, including growing loyalty between employees and employers, and the introduction of the Defined Benefit Plan. This means that when a person retired after working for the company, they would receive two thirds of their salary as a pension. Sounds great, right?

Generally speaking, at this point in history, a person worked their whole life towards one career, and spent 40 years working for the same company. The average life expectancy was just 69 years old, so theoretically, a company only had to pay out the Defined Benefit Plan for roughly 4 years post retirement. The intense loyalty and relatively short retirement meant that the responsibility towards employees and the risk of planning for their financial future sat with the employer.

The Gig Economy

Fast forward to today, as we stretch into a post-pandemic world, financial planning is a completely different ball game. The 4th Industrial Revolution kickstarted a new wave of workplace cultures and changes that lead us to where we are at present. Only time will tell if the Covid-19 pandemic has enhanced the 4th Industrial Revolution or sparked a whole new revolution globally.

Today, there is little loyalty between employees and employers, with people changing jobs and careers numerous times throughout their working life. Employer loyalty has also declined, as well as the Defined Benefits Plans being done away with in the 1990s. Meaning the onus and risk are now on the employee to plan for their own retirement instead of the company being involved.

The emergence of the Gig Economy where freelancing and short-term contracts have become popular birthed a far more individualistic culture within the workplace. There is also a strong trend towards acquiring a skill set instead of chasing a career. Your grandparents, and probably even your parents, worked throughout school, college and postgraduate programs towards a single, defined career. Today, however, kids and young adults are building up a skillset that will serve them across different careers and in many jobs throughout their lifetime. This enhances the Gig Economy and points towards a vastly different type of retirement.

Heaped on top of this, the average life expectancy today is 84 years old. Where previous generations were planning for just 4 years post retirement, we need to aim for 19 years. That’s a lot more years than your grandparents had to prepare for! It’s also why the Defined Benefits Plans became less popular as companies can’t sustain that kind of payout for that many years.

A synopsis

In a nutshell, we’re dealing with an entirely different landscape when it comes to retiring and financial planning. Here’s a synopsis:

Why should I care about how financial planning has changed?

Our hope is that your parents have had an open and frank conversation with you about retirement and planning for your future. But in reality, we speak to many clients that have not had helpful, if any, discussions with their parents or family about financial planning. This means that you might be marching towards retirement without a clear understanding of how to plan and prepare for it. At Wealthstack, we’re all about making money matters simple again. Which is why we’re urging you to care deeply about what the present and future of financial planning looks like for you and your family – so that one day you can live comfortably while also providing for the generations that come after you.

What can I do to prepare for Retirement?

Rethink Retirement

Gone are the days of single-track, one-size-fits-all careers. So why should retirement look like that? It’s time to rethink retirement! We’ve all grown up with an image in our mind about what retirement will look like and when it will start, but that image has been built by generations gone past that had completely different circumstances. Rather, let’s take a look at what the future might look like for YOU. What skill sets do you have that you could deploy before, during and after reaching “retirement age”? Could you start a business that will provide income for your latter years, and beyond? Could you continue to work past the age of 65? Things have changed, so should our expectation of retirement.

Rethink Today

Secondly, perhaps we should set, build and plan our finances around a way of living that allows us to truly live today whilst we’re working, rather than waiting until retirement. This doesn’t mean blowing your savings on luxury holidays or buying that extravagant car. Rather, aim for financial wellness and prudently assess your income, expenses, savings, plans and goals so that you can live the life you want today, while still planning for the future. Here’s four simple steps to get you started towards financial wellness.

Remember that investing and contributing to a retirement savings plan is always a good idea, no matter what passive income you have planned for the future or lifestyle you are aiming for in retirement. Whatever plan you put in place or investment vehicle you choose, the key to this aspect of preparing for retirement is accountability.

Accountability Partner

Back in the 60s through to the 90s, your employer would have been your accountability partner. If you showed up for work day in and day out, year after year, you would be sure to receive your full retirement package. But today, that is not the case. In the Gig Economy and without employers paying Defined Benefit Plans, you carry the responsibility to plan for your own retirement. As a freelancer, no one is checking in with you to make sure you are working enough hours to meet your financial goals. And there isn’t a promised paycheck waiting for you when you sign your final resignation at retirement. You have to step up to the plate and manage the process from start to finish. And you have to make sure that you’re sticking to the plan.

When you set goals for yourself, you are 42% more likely to reach those goals if you write them down. But, astonishingly, you are 95% more likely to reach those same goals if you have told one other person about them. That’s a big jump in your chances. So this is your encouragement to not only set your goals and write them down, but to find one, trusted person with whom you can share your goals. Ask them to check in with you from time to time. This accountability will boost your confidence, discipline and surety for the future.

With the risk of your retirement sitting squarely on your shoulders, you have to think clearly and act decisively. Gone are the days of yesteryear’s cultures. Immerse yourself in understanding the present times and what you can do to prepare for your future, and the future of the generations that follow you. Future-you will thank today-you for choosing to take practical steps and get ready for a realistic retirement.