How $200 a Month Can Maximize Your Financial Wellness

Many people believe that achieving financial wellness requires significant sums of money, but the truth is that even modest contributions can make a substantial difference over time. In this article, we’ll explore how allocating just $200 per month can help you make significant progress on your financial journey and maximize your financial wellness. By breaking down your financial goals and making strategic choices, you can move your Dashboard forward and work towards a more secure future.

1. Building Your Home Deposit Fund:

If you’re dreaming of homeownership, allocating $200 per month towards a home deposit goal is a smart move. By using for example Tax-Free Savings Account (TFSA) or First Home Savings Account (FHSA) as a vehicle for your savings, your $200 monthly contribution can grow into a fair amount over 15 years. In fact, you could potentially accumulate up to $60,000, providing a solid foundation for your future home purchase.

2. Investing in Education:

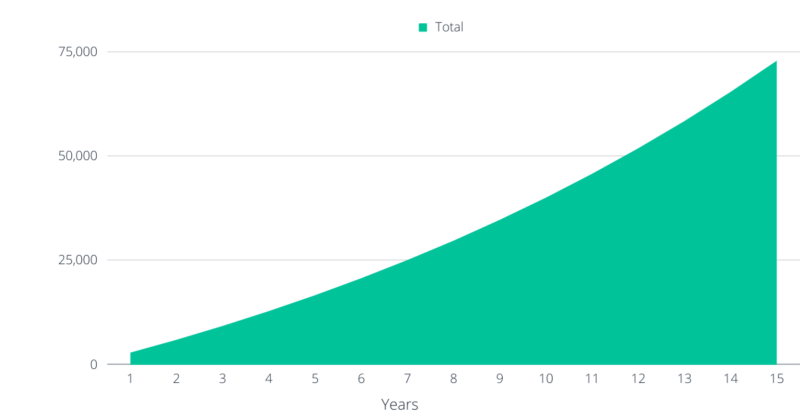

For those with educational aspirations, directing your $200 monthly investment into an RESP (Registered Education Savings Plan) can yield impressive results. Over 15 years, the government grants and compounded growth can turn your contributions into a significant education fund (shown in the graph below). In some cases, your $200 monthly investment could grow to approximately $72,500, offering support for your children’s educational pursuits.

3. Preparing for a Comfortable Retirement:

Saving for retirement is a top financial priority for many. By consistently contributing $200 per month to your retirement savings, you can significantly bolster your nest egg. With the power of compounding, diligent savers can amass a substantial retirement fund over time. Even a modest monthly contribution can add up, potentially resulting in a retirement amount exceeding $75,000 when combined with tax refunds and investment returns. On its own, this might not be enough, but added to your other investment accounts will give you stability in a brand new season of life.

4. Safeguarding Your Financial Future:

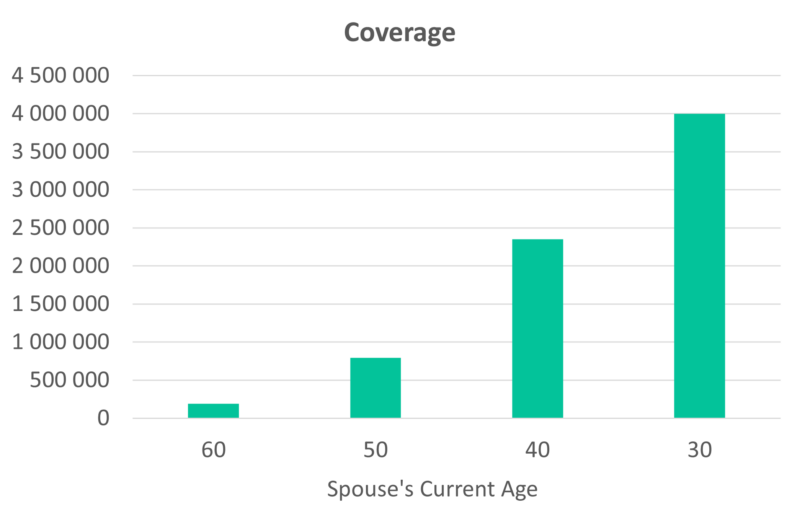

Besides savings and investments, it’s crucial to protect your financial well-being. With as little as $200 per month, you can secure critical illness and/or disability coverage, ensuring financial support in case of a health crisis. Depending on your age and coverage needs, your monthly premium can provide substantial lump-sum benefits, giving you peace of mind and financial security.

5. Providing for Your Loved Ones:

Lastly, consider using a portion of your $200 monthly budget to purchase life insurance coverage for your spouse. Surprisingly, for just $200 a month, you can potentially acquire millions in life insurance coverage for a defined period, offering financial protection for your family’s future.

Need to find the $200 first?

If you’re balking at $200 a month because you don’t think you’ve got that to spare, how about chatting to a Wealthstack Expert before you give up? At Wealthstack, we understand that managing your finances and making the most of your monthly budget requires more than just advice – it demands a tailored approach. That’s where our dedicated Wealthstack Experts come into play. They work closely with you to identify opportunities and create extra space in your budget, ensuring that every dollar is put to its best use.

Our first step is to utilize our budgeting tool, designed to help you gain clarity on your financial inflows and outflows. By working through this tool with a Wealthstack Expert, you’ll uncover hidden opportunities and areas where you can optimize your spending. Together, you’ll craft a budget that aligns with your goals and frees up additional funds for your financial journey.

Found it! Now you need the right partner:

Once you’ve fine-tuned your budget, your Wealthstack Expert becomes your strategic partner in maximizing the impact of your $200 monthly allocation. They take into account your specific financial goals, whether it’s saving for a home, funding education, securing your retirement, or safeguarding your family’s future.

With their expert guidance, you’ll gain a clear understanding of how to best allocate your funds to achieve your unique objectives. Whether it’s optimizing your savings strategies, selecting the right investment vehicles, or ensuring you have the right insurance coverage in place, the Wealthstack Expert helps you make informed decisions. They work with you to create a comprehensive financial plan that not only respects your budget but also puts your money to work effectively.

Don’t underestimate your $200

Many people underestimate the impact of small, consistent contributions to their financial well-being. By allocating just $200 per month strategically, you can make significant progress towards your financial goals and maximize your financial wellness. The key is to leverage expert advice and prioritize your financial objectives, turning your financial dashboard into a roadmap for a more secure and prosperous future. Remember, even small steps can lead to significant financial achievements when taken consistently and with purpose.